Elizabeth L. Morgan

Owner

Elizabeth L. Morgan (formerly Elizabeth Morgan Schurig) represents a wide array of clients faced with multi-jurisdictional tax, estate, and business planning issues. She is experienced in the design of complex estate and business plans for U.S., non-U.S., and dual-citizen clients, and in assisting such clients with their pre-immigration and expatriation tax planning. Ms. Morgan frequently advises clients on the resolution of international tax and treaty issues in connection with their estate and business planning, and serves as outside counsel to several high net worth family offices. She has formulated and administered estate and business plans for individuals and entities with ties to Australia, the Bahamas, Canada, the Channel Islands of Jersey and Guernsey, China, Costa Rica, the Czech Republic, Dubai, France, Germany, India, the Isle of Man, Israel, Italy, Liechtenstein, Mexico, Nepal, the Netherlands, New Zealand, Oman, Panama, Portugal, Spain, Switzerland, and the United Kingdom. In addition to her expertise in the design, administration, and tax compliance of both inbound and outbound foreign trust and business structures, she has an extensive background in traditional probate, trust, and estate administration. A frequent author and speaker in the areas of domestic and international estate planning, asset protection, and foreign trust planning and tax compliance, Ms. Morgan has been quoted in various publications, including The Wallstreet Journal, Practical Accountant, Investments & Wealth Monitor, and Bloomberg Wealth Manager. She is a contributing author (since 1995) and co-editor (since 2000) of the four-volume treatise, Asset Protection: Domestic and International Law and Tactics (Thomson/West Group, updated quarterly). Her 2003 article, “A Charging Order is the Exclusive Remedy Against a Partnership Interest: Fact or Fiction?” was quoted in the Florida Supreme Court dissenting opinion in Olmstead v F.T.C., 44 So. 3d 76, Fla., 2010.

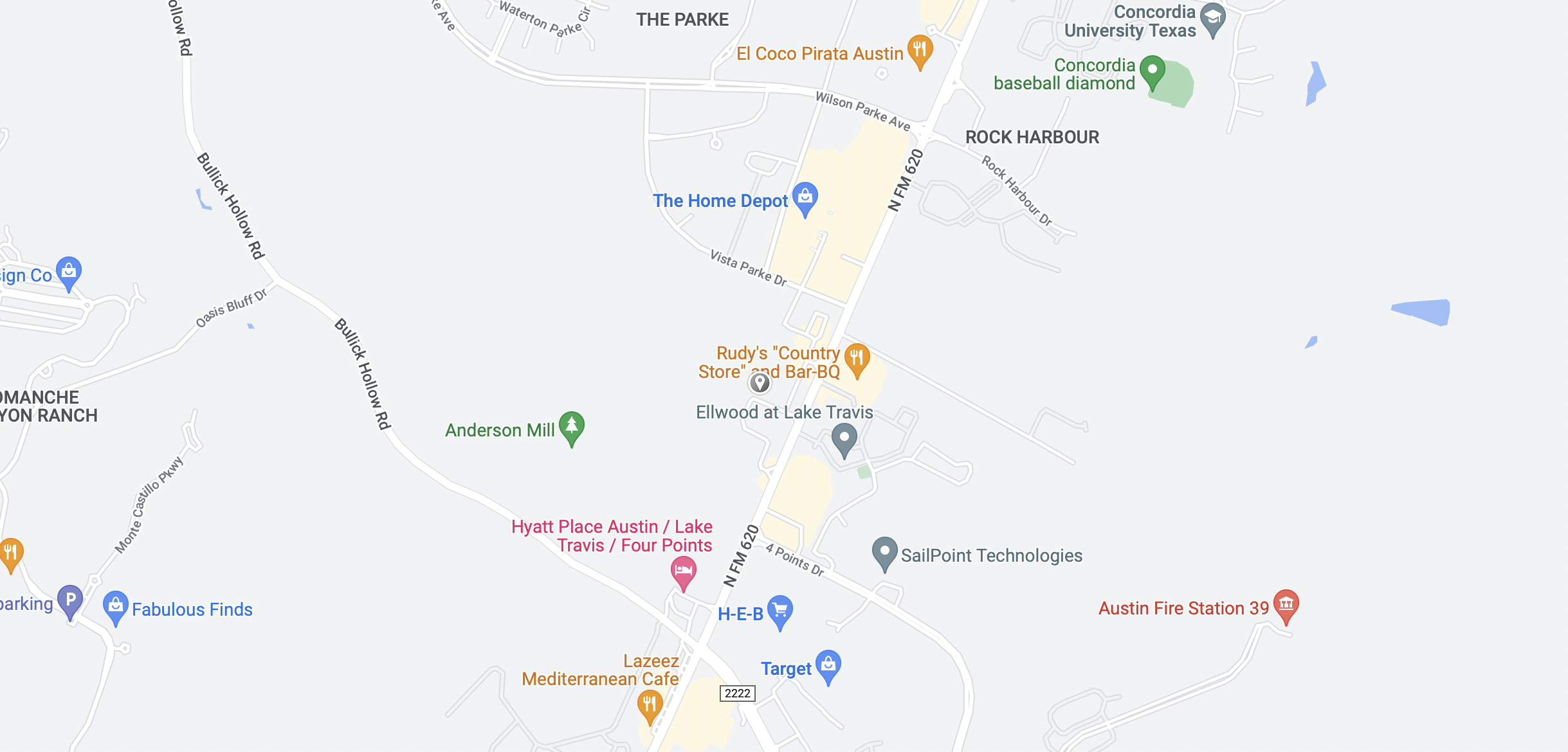

Get Directions

Get Directions